Why Asia?

PUBLISHED NOVEMBER 02, 2013

Learning from Asian businesses

WHILE Asian business leaders still flock to swanky business schools in the US and Europe, one leadership guru from a top-tier management school feels that Western companies can learn from the practices of Asian businesses and their leaders.

The business leader of the new age will therefore need to adopt a new model of management, which is influenced by Asian characteristics. Value creation and the growing importance of cultural intelligence are the new trends.

"For starters, leaders of companies in the West could learn from their Asian counterparts to be less reliant on ego and to place more emphasis on practice," said Nigel Nicholson, professor of organisational behaviour at the London Business School in the UK.

"Western companies seem too preoccupied with the identity of the leader to determine the capacity of the business. I do not think that is right as a core capability such as excellence in execution is important," he told The Business Times.

- http://online.wsj.com/article/SB10001424052702304906004576371331543461802.html

- http://www.economist.com/news/economic-and-financial-indicators/21576398-gdp-forecasts

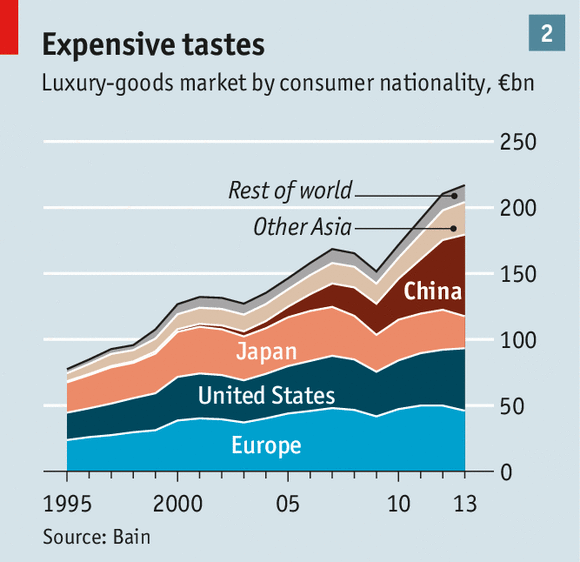

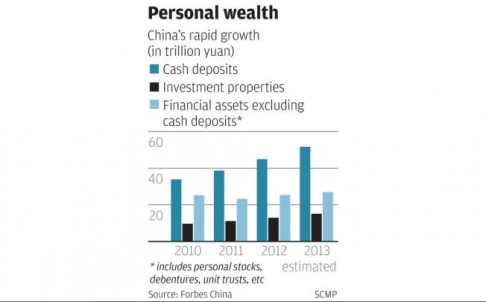

The luxury industry has taken note that there are distinct

characteristics of China’s millionaires which affect the ways in which

companies choose to market to them. According to the report, the main

driver for China’s wealth accumulation in 2012 was economic growth

rather than a rebound in equity markets that helped developed nations,

meaning China’s rich tend to tilt toward hard assets when it comes to

investment.

Chinese millionaires are also younger on average than those from other countries. A 2012 Hurun report found that Chinese millionaires’ main areas of consumption include travel, education, and real estate.

Pivate-equity firms are sitting on $120 billion in funds to be invested in Asia, the most cash they have ever had on hand. But the region's small markets, tough governments and fierce competition for deals could make it hard for firms to invest all that money profitably, industry watchers say.

Drawn by the promise of strong economic growth, investors have been pouring money into Asia for years, even though returns have lagged behind those in North America. Private-equity firms operating in Asia returned 6.5% in the year ended in March, compared with 12.7% in North America, according to data provider Preqin. In the five years ended in March, Asia funds had internal rates of return—a private-equity benchmark for the profitability of a deal—of just 3.9%, compared with 6.8% in North America.

"You do hear concerns that with all the money being raised and deal levels not at the levels you'd like to see, where is this money going to go?" said Michael Buxton, Ernst & Young Asia-Pacific private-equity leader.

The large economies where big deals are available—Japan and South Korea—aren't particularly friendly toward private equity, and when there are deals, competition is rife. Targets in high-growth markets like China or Southeast Asia tend to be small. Many of the region's initial-public-offering markets remain quiet or, in China's case, completely shut, making exits on past investments tough.

The $120 billion of unspent capital that Asia-focused private-equity firms hold is 54% more than they were sitting on five years ago, when the financial crisis started, Preqin data show. And private-equity deal activity has slowed since before the crisis: This year, just $17.3 billion in private-equity deals have been done in the Asian-Pacific region, compared with $42.5 billion in all of 2007, according to data provider Dealogic. Private-equity funds focused on Europe and the U.S., meanwhile, are sitting on less unspent money than they were five years ago.

Money has piled up thanks to successful fundraising by firms like KKR KKR -1.00% & Co., which raised a $6 billion Asia-focused fund this year, the largest private-equity fund ever for the region. CVC Capital Partners, a European private-equity firm with a global footprint, also started raising money for a new Asia fund in recent months, targeting $3 billion, and TPG Capital has brought in at least $2.5 billion for its sixth Asia fund, with the aim of raising another $1 billion by the end of the year, people familiar with the matter have said.

KKR co-founder Henry Kravis recently expressed confidence that the firm can deploy its capital in Asia, given the region's growth potential. TPG and CVC declined to comment.

Even more money may be coming. Preqin estimates 259 firms are actively raising a collective $77 billion more to invest in the region. Combine that with the existing dry powder, and private-equity firms could theoretically end up with enough capital—at around $197 billion—to buy nearly the entire Philippine stock market.

It is hard to see the pool of private-equity money in Asia shrinking anytime soon.

The hope among private-equity firms is that big markets such as Japan and South Korea, which haven't been friendly to these investors, will become more open and make it easier to invest the cash haul. There have been recent moves in that direction, but it is unclear how sustainable they are.

Last year, KKR lost out to a government fund when it bid for Japanese electronics maker Renesas Electronics Corp. RNECY -1.18% The U.S. firm also hit a roadblock in Taiwan in 2011 when a $1.6 billion offer for electronics components maker Yageo Corp. 2327.TW 0.00% was rejected by regulators.

Asia's biggest economy, China, has limited foreigners from investing in sensitive industries like defense-related companies or education and the Internet.

Private-equity firms have long managed to buy only minority stakes in companies because many first-generation entrepreneurs haven't wanted to sell.

Now private-equity firms are facing a potentially slowing economy and one where exits are few, after China put a moratorium on domestic initial public offerings last year following a succession of poorly performing IPOs.

"The IPO markets [in China], even if they are open and functioning well, they can maybe handle 300 plus-or-minus PE-backed IPOs a year," said David Brown, Greater China private-equity leader at PricewaterhouseCoopers. "There are thousands of companies being held by private equity."

Southeast Asia, meanwhile, is home to many small companies, and even when the firms are big, stakes available can be small. KKR said it closed its first deal out of the new Asia jumbo fund this week, investing $200 million for a minority stake in a Malaysian oil and gas transportation-services firm.

To be sure, there are some signs Asia's landscape may be changing as governments move to restructure domestic industries and push for more openness to foreign investors. Asia's biggest private-equity transaction this year, for instance, was done in South Korea, where Seoul-based private-equity firm MBK Partners bought ING Groep ING +0.16% NV's Korean life-insurance operations in a $1.6 billion deal. There could be more to come as regulators have said they will introduce a new plan to ease rules for private equity in October.

And after years of being perceived as having an inflexible corporate culture, Japan, too, is trying to improve its image. Prime Minister Shinzo Abe has been pushing policies to help companies boost profitability since he took office. KKR just landed its biggest deal in Japan when it agreed to buy Panasonic Corp.'s6752.TO +2.80% health-care unit for $1.7 billion.

It has taken awhile: Mr. Kravis, the American firm's co-founder, has been traveling to the country since 1978, but had only made one investment in Japan prior to the Panasonic deal.

- 2013 October 13 Wall St. Journal