Too much money! For ol' handbags...Moneybags

An IPO in Hong Kong recently was 2,100 times oversubscribed indicating the volume of wealth with these new Chinese; and their gaming instinct thru investing in the stock market

Sales of luxury goods in China grew 12% in 2009, to $9.6 billion, accounting for 27.5% of the global market, according to Bain & Co. In the next five years, China's luxury spending will increase to $14.6 billion, making it the No. 1 luxury market globally. In 2009, China overtook the U.S. to become the world's second-largest luxury-goods market, behind Japan. Roughly half of the luxury goods purchased in China are bought as gifts - AD AGE

This CNY - Year of the Rabbit - plants and flowers are sold out because all the Mainlanders have been buying up!! And big developers are chasing their money. Talk about buying power? Its the 340,000 USD millionaires who are the new rich of China who the world seems to be focussed on.

Two years ago, GM was broke and governments bailed them out but now GM had its IPO and a roaring success and it was because of the Chinese consumers buying those GM cars in China. Hurrah for the new Asian middle class who are much more worldly and richer than the previous generation. We have been tracking this trend and building this platform as a venue to those super rich of Asia, for a long time as you can tell by the press clippings below.

- China's Top Brands

- Chinese are shopping vs U.S.

- China's Nouveau Riche

- Shanghai bling

- Hong Kong attracts the highest percentage of luxury fashion brands

- China shoppers online in flocks

- Wealthy in China are younger

- Profiling China's Luxury Consumer

- China's Nouveau Riche

- Luxury Brands in China

- China : The next super consumer

- Chinese consumers now rank as the world's second-largest spenders on luxury goods after the United States.

- Wealthy in Chinese are young

- Personal Shopper

- $6K Loo for the 'Grand' sort of Rich

- Saudi princess abroad

- Elite university offer Courses in Life for Rich Children

- Buffet embracing China-made suits

- Yikes! They're making fun of us

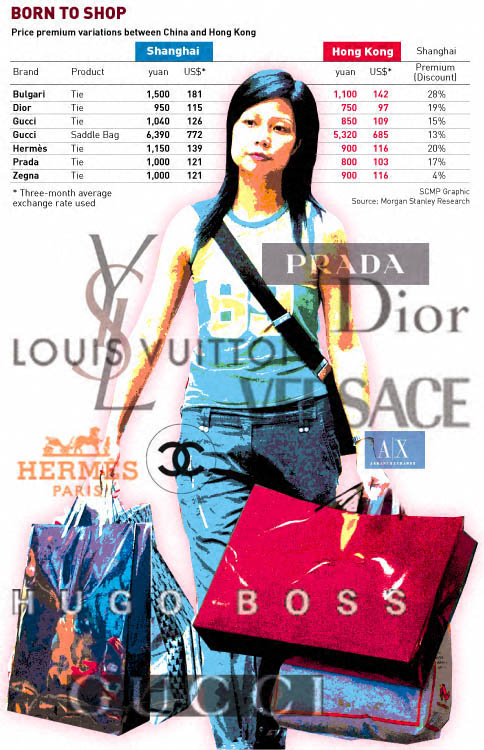

- Cross border shopping - to Hong Kong!

South Korea is emerging as one of the most "luxury friendly" places in the world, as the country's growing wealth mixes with a rising tide of shopping-minded tourists, a survey by McKinsey & Co. shows the survey, which focused on people who have purchased luxury goods, found that such products appeal more to South Koreans shoppers than in other countries.

Few South Koreans feel guilty about spending money on luxury-brand items or think that they are wasting money on them, the survey found. Only 22% of South Korean respondents said they think that showing off luxury goods is in bad taste—considerably lower than Japanese and Chinese respondents.

In part, that's due to South Korea's homogenous culture, which both encourages people to distinguish themselves with high-end products and pressures them to keep up with those who do.

Additionally, a deep tradition of craft-oriented trades in the country has created a "respect for very fine products," says Aimee Kim, a McKinsey partner in Seoul who specializes in consumer markets. "Some purchasers may have initially purchased a luxury item to conform, but after the first purchase, they notice a difference in quality."

She said the results of the survey show there's still room to grow in South Korea for luxury brands, which have raced to the country in recent years. Several Korean conglomerates and investor groups acquired luxury brands from European owners over the past decade as well.

Amid the global economic slump, only shoppers in South Korea and China in the McKinsey survey expressed in sizable numbers that they spent more this past year on luxury goods than before. Some 46% of South Koreans in the survey said they spent more in the past 12 months on luxury items than before, while 44% of Chinese said so. Those figures were sharply higher than the single-digit rates for Japan, the U.S. and Europe

South Korea accounts for about 4% of global spending on luxury goods. Its rise has been slowed somewhat by the concentration of distribution through department stores and duty-free shops.

But last year, for the first time, big luxury brands could operate stand-alone stores at new malls in Seoul and Busan. Several other new shopping centers are planned for Seoul and Incheon that would house stand-alone stores for big brands.

Also, luxury retailers in South Korea drew tourist shoppers from Japan and China in huge numbers during the past year, when the Korean won was sharply lower against other major currencies. - 2010 July 20 ASIAN WALL ST. JOURNAL

McKinsey & Co. forecasts that by 2015 China will rank fourth in the world by number of wealthy households, with a total of 4.4 million. Right now about 80% of wealthy Chinese are aged 18 to 45, compared to 30% in that age group in the U.S. In a recent survey by Ruder Finn, 50.3% of consumers in Greater China say they will not let the global economic downturn affect their purchases of luxury goods. They also appear to be remarkably loyal, with 89.3% of respondents saying they will stick to their preferred luxury brand despite the crisis, with Louis Vuitton and Cartier being two of their favorites. Sources: McKinsey & Co., Ruder Finn, Harvard Business Review 2009 September 16 AD AGEChinese eclipse super rich in luxury shopping

(LONDON) Gloom-defying shoppers from China are flocking to the luxury stores of London's West End, outspending Arab royalty, replacing Russia's departing super-rich and lifting spirits after nine months of recession.

Data from tax-rebate companies suggests Chinese tourists are spending three to four times more than a year ago in London's chic shopping districts.

On Bond Street, famous for its designer boutiques and jewellers such as De Beers and Graff, figures from firms which arrange sales-tax refunds for tourists suggest Chinese shoppers are now overtaking big spenders from the Gulf states, Russia, the United States and wealthy Nigerians.

'We are looking for good-quality branded stuff,' said Lillian Wang, a 28-year-old bank worker from Beijing, on Oxford Street, one of London's mainstream thoroughfares. 'I'm not as crazy as others, buying a dozen Louis Vuittons (bags), but I'm sure they are a lot cheaper here than in Beijing. 'A cheaper pound has also helped.'

Thanks to a four trillion yuan (S$845 billion) stimulus package and record lending by the country's state-owned banks, China is likely to hit the government's target of 8 per cent growth this year, by far the fastest rate of any major economy.

This has offset a slump in export demand and sustained the rise in incomes that made Chinese shoppers, especially the well- heeled, a rich seam of profit for Europe's luxury brands.

'Income growth - particularly the top end, also driven by wealth accumulation - remains robust in China,' said Linda Yueh, a fellow in economics at Oxford University. 'Thus, wealthy Chinese may find that the weak pound makes Britain an attractive place to shop.'

Sterling has recovered from lows early this year against currencies such as the dollar and yuan, but is still far short of mid-2008 levels.

Britain has been in recession since the last quarter of 2008, when GDP shrank at its fastest rate since 1980. A survey by the Confederation of British Industry showed retail sales fell more sharply than expected in August.

In this environment, tourists from China and other Far Eastern countries will have little impact on Britain's economy as a whole, says Richard Perks of market research group Mintel.

'It's going to have a big impact on some stores, and it might have a perceptible impact on London's retail sales. But it is hardly going to be significant for the country as a whole,' he said.

Ms Wang's shopping bags reflect a difference in spending habits among Chinese visitors from other wealthy shoppers: Besides a £900 (S$2,110) suit for her husband, she had a more modest £50 pair of shoes for herself.

As well as top labels, the Chinese are drawn to more prosaic items, and they are not as seduced by lifestyle offerings.

For example, top-end retailers have employed Mandarin-speaking sales staff to cope with the influx of Chinese customers but London's chic hotels have yet to benefit, said Charles Wang of tour operator Travco.

'You still find that the majority of Chinese shoppers stay at four-star standard hotels in London but at the same time easily spend thousands and thousands of pounds on brands like Louis Vuitton, Gucci, Armani and Burberry,' he said.

Anecdotal evidence also points to a strong Chinese taste for sports equipment and furniture.

Nonetheless certain items seem to hold universal appeal, according to Bruno Barba, spokesman for department store Selfridges. 'Chinese, Middle Eastern and Russian customers all share a love of the luxury accessory - whether handbags, fine jewellery or watches.'

Jewellery demand in China, the world's second- largest gold consumer, rose 6 per cent in the second quarter of 2009 from a year earlier, against a 31 per cent drop in India and a 9 per cent decline in global demand for gold.

Mr Barba said Chinese customers now rank among the five top-spending groups at Selfridges, regardless of the season.

The trend is even more marked elsewhere.

Global Refund, which arranges sales-tax refunds for tourists, reported a 164 per cent rise in sales to Chinese customers on Bond Street in the first seven months of 2009 from a year ago.

Spending by Russians fell 27 per cent, although at £1,295 their average spend was still higher than the Chinese shoppers' typical £972.

'In spite of the downturn, the growth in Chinese spending is a trend we expect to continue to the end of 2009,' said Global Refund's vice-president of UK sales Nigel Dasler. 'Seventy per cent of their tourism expenditure is on shopping.' - Reuters 2009 September 02 BUSINESS TIMES

Wealthy Chinese account for less than 1% of urban households in the mainland but represent an important segment that shouldn't be overlooked by marketers. China will have more than four million affluent households by 2015 - McKinsey 2009

Already worth 12% of global sales for luxury goods, China will account for one-quarter of world demand for premium brands by 2016, according to TNS. A rising middle class is spurring growth.

China's luxury-goods market reached $1.145 billion in 2007, accounting for 18% of global sales. More than 300 tons of gold jewelry a year is sold in China, second only to India. Of the world's top luxury brands, 80% have already entered China. - Xinhua

The Cult of the Luxury Brand, a book by brand and retail consultants Radha Chadha and Paul Husband, calculate the global luxury market at $80 billion, with Asia comprising 37 per cent. - 2008 Spring FQ MAGAZINE

Just over 16% of affluent Chinese in Shanghai say they are unaffected by the global recession now creeping into China, according to a new survey conducted by Touchmedia, an in-taxi interactive media company in China. - 2009 February 19 ad age

Millionaires in Hong Kong have lost HK$660,000 on the average as a result of their investments in stocks, foreign exchange and other financial ventures.

The loss represents about half their liquid assets, according to a survey by Citibank.

The findings also found most millionaires expect the Hang Seng Index will trade in a range between 10,000 and 15,000 points.

About 47 percent of respondents said they will be more conservative this year while 74 percent said they will cut their investment. - 2009 February 19 THE STANDARD

Designer brands battle for slice of booming Asia market

Luxury brand Chanel's choice of a Hong Kong carpark roof to launch a global-trotting art exhibition raised some eyebrows, but the location reflected Asia's growing importance to the fashion world. Chanel's flamboyant pony-tailed designer Karl Lagerfeld described the venue, besides the city's famous Victoria Harbour, as stunning. "Hong Kong is most beautiful at night," he said at Wednesday's launch of the Mobile Art Museum, a moveable structure by architect Zaha Hadid that exhibits work by 20 artists based on Chanel's quilted handbags.

Vincent Shaw, Chanel's president for Asia Pacific, said Hong Kong was carefully chosen as the best place to launch the exhibition before it tours other fashion capitals around the world, including London and New York.

"Asia has a huge population and an incredible liquidity. We believe that there's huge opportunity and Asia is going to be very successful," Shaw said. Asian consumers account for more than 50 percent of the annual 80 billion dollar sector, more than the US and Europe combined, according to Radha Chadha co-author of the book "The Cult of the Luxury Brand."

"The reason why Asians buy so many luxury brands is that in Asia you are what you wear. A luxury brand is a symbol that defines who you are and your social status," Chadha told AFP.

"People judge each other by what brand of handbag they are carrying."

With Asia being the world's biggest market for Western luxury goods, international brands are shifting focus from Paris, New York and London to the fast-growing emerging markets in the region.

Major designer brands, including Christian Dior and Gucci, spent more than 60 million dollars on advertising in Hong Kong last year, 23 percent more than in 2006, according to a study by market researcher Nielsen. This Friday, Hong Kong will see Louis Vuitton step up the battle for a bigger slice of the Asian market with the re-opening of its massive store after a year of renovation - more than double the size of its old shop.

The store, across the harbour from Chanel's mobile art gallery, is Louis Vuitton's second-largest after its flagship building on the Champs Elysees in Paris.

Jean-Baptiste Debains, Louis Vuitton's president for Asia Pacific, said the company has recorded double-digit annual growth in Hong Kong. "The Hong Kong market is quite mature but is still growing. We have strong potential with the local customers because of the growth of wealth and the economy as a whole," he said.

Chadha predicts that Hong Kong's neighbour - mainland China, one of Louis Vuitton's fastest-growing markets - will overtake Japan as Asia's biggest luxury market in seven years, with India set to storm ahead too. In mainland China, Louis Vuitton has already 18 stores located in Beijing, Shanghai and in other smaller cities, with six more expected to open this year. "There are a lot of cities in China where we can have stores, maybe not today, maybe in three years," Debains said. But it is not all about China.

Vietnam has also become a focus for the company, with chief executive Yves Carcelle quoted in the Financial Times as saying revenues there grew more than 300 percent last year.

Louis Vuitton will also open stores this year in Indonesia, South Korea and Taiwan. Coach, the US maker of handbags and accessories, said it aims to grow its Chinese operation by more than 60 percent over the next few years and will open a global flagship store in Hong Kong this summer.

The combination of mainland China, Hong Kong, Macau and Taiwan have the potential to become the third major market for Coach, following North America and Japan, it said.

Chadha warned the economic slowdown in the United States, with fears the world's largest economy is slipping into recession, was likely to hit luxury goods consumption. But Louis Vuitton's Debains said growth in Asia looked unstoppable.

"I feel there's a stronger dynamism and energy in Asia. Maybe that is because we have the economic growth that creates the kind of spirit that pushes people to go forward," he said. - 31 March 2008 ASIA PACIFIC POST

China's Lust for Luxury

Affluent fluent Chinese once stocked up on fine silks and porcelain. Today it's Italian leather handbags and premium cognac. If the economy keeps growing at its breakneck pace, China will soon surpass the U.S., Europe, and Japan to become the world's leading market for luxury goods, says Bernard Arnault, chairman of LVMH Moët Hennessy Louis Vuitton , in an interview with Women's Wear Daily. - 2007 November 1 BUSINESS WEEKIndependent sources estimate China will consume up to 30 percent of all the world's luxury products by 2015. - 2007 November 5 THE STANDARD

Asia Leads

Hermes Sales Rise

PARIS — In another sign of luxury's vigor, sales at Hermès International rose 12.3 percent in the third quarter to 394.7 million euros, or $542.3 million, from 351.4 million euros, or $446.3 million, a year ago - 2007 November 9 WOMENS WEAR DAILY

Sales climb on

Chinese demand for watches

Richemont, the world's second-largest maker of luxury goods, reported five-month sales growth Thursday that beat analysts' estimates, with wealthy Chinese and Russians buying more Mont Blanc watches and Cartier jewelry.Well-off young, elderly are big luxury spenders: report

Revenue rose 17 percent from April through August, excluding currency movements, over the similar period in the previous year, the company, based in Geneva, said during a shareholders' meeting. That exceeded the 15 percent median estimate of 12 analysts surveyed by Bloomberg.

The chairman, Johann Rupert, said his "principal concern" was meeting surging demand for watches.

Swiss watch exports had their steepest increase in two years in July. China and Russia have become the fastest-growing markets for luxury goods.

"We had expected Rupert the Bear to emerge this morning, and he was more neutral than we would have expected," a Merrill Lynch analyst, Antoine Colonna, wrote in a note to investors. "Asia was the most dynamic region. There is, unsurprisingly, a cautious tone on capacity constraint issues."

Richemont shares rose 1.60 Swiss francs, or 2.2 percent, to close at 74.20 francs, or $62.49, in Zurich. They have gained 26 percent in the past year, less than the 38 percent increase by registered stock in Swatch Group, the world's biggest watch manufacturer and owner of the Breguet and Blancpain brands.

"We are addressing the whole supply question, with plans for further expansion of our watchmaking capacity," Rupert said during the meeting.

Sales growth accelerated in July and August as overall Swiss watch exports surged, said the chief executive, Norbert Platt.

"By the pure law of statistics, it cannot continue," he said. "If it continues like this, everyone will need to have 10 watches on their arm in the next five years or start collecting."

Chinese growth is "phenomenal," said Alessandro Migliorini, an analyst at Helvea in Geneva. "That's making up for slower development in Japan and could make up for a slowdown in the U.S., if that would ever happen."

Richemont regularly publishes a five-month sales report at the time of its annual general meeting. Analysts typically focus on revenue excluding currency movements.

Total revenue climbed 11 percent in the five-month period over the period in the previous year, higher than the Bloomberg survey's 10 percent median estimate. Sales rose 14 percent in Europe, which was Richemont's largest market last year, generating about 40 percent of total revenue.

Revenue increased 11 percent at the Mont Blanc unit, known for its pens, as the division expanded further into watches, jewelry and leather goods.

Sales climbed 22 percent in Asia and advanced 6 percent in the Americas. In Japan, revenue fell 4 percent because of declines by the yen against the euro.

The Americas and Japan account for about a third of sales at Richemont, which also makes Lancel leather goods and Purdey shotguns.

Watch revenue climbed 20 percent in the five-month period, while sales of jewelry gained 8 percent. Revenue from leather goods was "broadly in line" with last year, Richemont said, without elaborating. Sales from Chloé, the luxury fashion brand, rose 12 percent.

LVMH Moët Hennessy Louis Vuitton, the maker of Dior watches and Chaumet jewelry, is the world's largest luxury-goods company. - BLOOMBERG 2007 September 14

They will account for 83% of spending on luxury goods, services in 10 years

When it comes to spending patterns, the young and the old have a lot in common, a new report from MasterCard shows.Rising ranks of super-rich Chinese pushing up prices

Older people in Singapore and the Asia-Pacific region are expected to increase their spending on luxury items by 2.7 times to US$800 million by 2016, says the credit card organisation's latest Worldwide Insights Report.

The other key segment that is set to boom is the young premium market, which MasterCard said will grow 2.2 times to US$1.1 billion in the same period.

'The young premium segment is especially important as they are the best educated and are the primary beneficiaries of Singapore's transition to a knowledge-intensive and service-driven economy,' the report says.

However, apart from the Asian giants of China and India with their masses of young people, demand from the older premium consumers - those above the age of 60 and in the top third of the market by household assets - is seen as outpacing growth from the young premium consumers, defined as those in the top third of income earners with no children.

In US dollar value terms, Japan is expected to lead with the older premium market growing from US$27 billion in 2006 to US$67.8 billion in 2016.

Japan has a rapidly ageing population. With their accumulated wealth and more time to spend it, and with continued good health, the demand characteristics of this segment are changing too, the report shows.

'Instead of looking for items to buy, they seek enjoyable experiences,' it said. With many of these consumers leading active lifestyles and being avid travellers, MasterCard suggests that they might prefer authentic experiences at sites of cultural or historical interest instead of places like beach resorts.

'Their definition of luxury is therefore very likely to be very different from the usual consumption of luxury brands, expensive jewellery and related personal items,' the report says.

In one illustration of this trend, the report says that in Australia, the average age of Harley Davidson motorcycle owners was 55 years, suggesting that many of these classic bike enthusiasts are in their 60s or 70s - and presumably still seeking active lifestyles.

The report estimates that well-off young people and their prosperous elders will together account for about 83 per cent of the US$258.7 billion that will be spent on luxury goods and services within the next 10 years, making them the two most important niches to target. - by Vincent Wee SINGAPORE BUSINESS TIMES 2007 September 5

China has 150,000 super-rich with personal wealth of US$5 million or more and their ranks are rising fast, pushing up prices for golf, yachting, villas and other luxuries, researcher Rupert Hoogewerf said yesterday.New urban rich Chinese are keen to travel: survey

'The number of wealthy individuals in China is growing very fast, based on the economic boom,' Mr Hoogewerf, who compiles an annual China 'rich list', said in an interview.

Catering to the rich: Hermes International said in June it aimed to triple its stores in China to 25 in the next five years

His China Luxury Index, which tracks 32 items including the Rolls-Royce Phantom EWB and the Louis Vuitton Speedy Bag, shows prices of luxury products in China jumped 8.7 per cent in the year to this February, compared with a 3.5 per cent rise in the consumer price index.

Luxury properties, golf memberships and executive education led the gains, with the price of a 372 sq m villa in Shanghai rising 18.6 per cent to 19 million yuan (S$3.8 million).

Also fuelling the rise were China's culture of gift-giving and the implementation in April last year of a 10-20 per cent tax on certain luxury imports, he said.

Although most luxury goods are imported, they seem to have seen little price relief from the appreciation of the Chinese currency, the yuan, which rose 4.5 per cent against the US dollar during the period.

Mr Hoogewerf also said 50 individuals in China had wealth of at least US$1 billion, while 2,000 were above US$100 million and 35,000 exceeded US$10 million.

The growing numbers of China's wealthy have caught the attention of the world's luxury goods makers. Richemont's Cartier watch and jewellery brand said last month it planned to open 25 new shops in mainland China by March 2008, while Hermes International said in June it aimed to triple its stores in China to 25 in the next five years.

Overseas lenders such as Citigroup and BNP Paribas have set up private banking units targeting clients with investable assets of US$1 million or more and several of their Chinese peers, including the Industrial & Commercial Bank of China and Bank of China, are following suit. -- Reuters 16 August 2007

Compared with other countries, China's new urban rich are younger, better-educated and keener to travel, a survey by international credit card organisation MasterCard showed yesterday.HK has world's biggest shopaholics

China will have 8.5 million affluent households with annual income above US$25,000 by 2015.

The 25 million members of those households will have annual discretionary spending power of US$117 billion in constant dollar terms, the card firm estimated.

In 2005, China had 2.9 million such households with US$18 billion to spend on things apart from life's necessities.

Yuwa Hedrick-Wong, MasterCard's economic adviser, said China's wealthy were 'shockingly young' compared with their counterparts in North America, Europe and other emerging Asian economies.

According to the survey of 900 people in Beijing, Shanghai and Guangzhou with annual household income of between US$16,000 and US$50,000, more than two-thirds were under the age of 40.

'We have never seen such a phenomenon, that is, affluent families are dominated by young people,' Mr Wong told a news conference.

The survey found 83 per cent of China's young urban rich have a university education and nearly 80 per cent of them travelled abroad at least once in 2006. Their purchasing power can be felt 'far and wide', Mr Wong said.

In general, Hong Kong and Macau remain the top two foreign destinations for newly affluent Chinese. -- REUTERS 14 August 2007

Young working women in China spend nearly one-quarter of their income, $566 per month, on cosmetics and hairdressing. They also spend more than 3.5 months' income on clothes and accessories. Source: ChinaNews.com, McCann Worldgroup

'Office Ladies' becoming a big force in China's shopping malls

Spending spree: Shopping is the favourite pastime of many young, unmarried, working women in China's eastern cities

(SHANGHAI) Feng Qi is a marketer's dream. She's young, unmarried, has a stable income, and says her favourite pastimes are shopping and travelling abroad.

And there may soon be millions like her in China.

'I spend more than half of my salary on shopping every month,' says Ms Feng, a 27-year-old advertising manager who prefers to be known as Amanda Finn, an English name she adopted.

Shopping in China has become more fun with the entry of growing numbers of foreign retailers, she says as she strolls through a Zara store in fashionable downtown Shanghai, wearing a yellow pleated miniskirt and black jacket.

'There are so many brands to buy now, compared to a few years ago,' said Ms Feng, whose 7,000 yuan (S$1,374) monthly wage is above the average salary in affluent Shanghai of about 2,000 yuan.

Several decades after the so-called 'Office Ladies' emerged in Japan, and then in Asia's other affluent countries, they are becoming a prominent feature in China's booming eastern cities.

Their Japanese nickname, often shortened to 'OL', described a social as well as economic change - a modernising economy created white-collar jobs which let women delay marriage and lead independent lifestyles well into their 20s or longer.

OLs were an important factor behind the Japanese economic miracle as they boosted consumption and created demand for new luxury and leisure goods.

China's sheer size - its large cities with over one million inhabitants each, contain about 250 million people, which is nearly double the size of Japan's population - means its OL phenomenon could ultimately be much bigger.

Some say China's OLs could prove more important to overall consumption because, in contrast to their Japanese counterparts, they stay financially independent as they remain in the workforce after marriage.

'In Japan you have an 'office lady' who goes to work with the express knowledge that her primary objective is to find a husband and that there is no possible hope of advancement within the company,' said Tom Doctoroff, who heads advertising agency JW Thompson in Greater China.

'That is not happening here at all.'

Many Chinese OLs live with their parents until they get married, meaning disposable incomes are relatively high.

'I spend a lot of money in restaurants and I often buy fashion magazines to get inspiration for my shopping,' said 25-year-old marketing assistant Xia Yan.

She uses money that she would otherwise spend on rent, or might a decade ago have spent on family, for travel. 'I like to go to Hong Kong. Its a good place to get cosmetics, where prices are at least one-third lower.'

Cao Zheng, 33, who works for a Japanese bank in Shanghai, generally spends 1,000 to 2,000 yuan each time she buys cosmetics. Travelling is probably her main expense, she said.

'I travel at least once a year in China and once overseas every year. I went to Bali for Chinese New Year,' Ms Cao said.

With white-collar salaries on the rise in China, where Credit Suisse projects the value of domestic consumption could hit US$8.8 trillion by 2020, companies in the retail sector see potential.

'It's one of our main targets,' said Victor Herrero, managing director for Zara China, owned by Spain's Inditex. 'They're really fashion-oriented, they travel a lot, and they're eagerly looking for trends in the market. - REUTERS 2007 April 28

Hong Kongers are the world's biggest shopaholics, heading to the shops twice a week, a survey by market researcher ACNielsen shows.FACT:

The poll showed 93 per cent of Hong Kongers viewed shopping as a form of entertainment, compared with 74 per cent of consumers globally. The survey covered 22,000 Internet users in 42 markets.

Hong Kong promotes itself as a shoppers paradise as the territory is crammed with shopping malls and competition between retailers is intense.

Asians generally led the rest of the world in consumption, a reflection of their growing wealth, the survey showed. In China, 31 per cent of respondents said clothes shopping was their favourite thing to do and 20 per cent of Indians in the poll agreed. -- REUTERS 6 June 2006

The wealth that is emerging in China is staggering. Many of the foreign banks in Hong Kong have staffed up with Private Bankers who speak putong hwa. The luxury stores and developers too are catering to this new class of rich which is spread as wide as Canada and the United States. Some significant facts in the articles we've collected so far.

Oct 19th 2006 | HONG KONGA sharp slowdown in the American economy could be offset by the growing and largely unrecognised power of Asia's consumers American consumers have been one of the main engines of global growth for the past decade. But now, as America's housing boom threatens to turn into a bust, many forecasters expect household spending to stall. A few even worry that America could come perilously close to a recession in 2007. Previous American downturns have usually dragged the rest of the world economy down, too. Yet this time its fate will depend largely upon whether China and the other Asian economies can decouple from the slowing American locomotive.

From The Economist print edition

According to conventional wisdom, American consumers have single-handedly kept the world economy chugging along, whereas cautious Europeans and Asians have preferred to save. Yet the importance of America's role in global growth is often exaggerated. During the past five years America has accounted for only 13% of global real GDP growth, using purchasing-power parity weights.

The real driver of the world economy has been Asia, which has accounted for over half of the world's growth since 2001. Even in current dollar terms, rather than PPP, Asia's 21% contribution to the increase in worldGDP exceeded America's 19%. But current dollar figures understate Asia's weight in the world, because in China and other poor countries things like housing and domestic services are much cheaper than in rich countries, so a dollar of spending buys a lot more. If you want to compare consumer spending across countries, it therefore makes more sense to convert local currency spending into dollars using PPPs rather than market exchange rates.

However, the doomsayers argue that Asia's growth has itself been based largely on exporting to America, whereas domestic demand in the region has languished. Their evidence for this is that Asia is running a combined current-account surplus of over $400 billion, implying that it is contributing much more to world supply than to demand. Thus if America's demand stumbles, the growth in Asia's exports and output would also plunge.

Asia's export growth would certainly slow sharply, but it is the change in net exports that contributes to a country's growth rate, not the absolute size of that surplus. Since 2001 the increase in emerging Asia's trade surplus has added less than one percentage point a year on average to the region's average growth rate of almost 7%. Contrary to the received view, the bulk of Asia's growth has been domestically driven. True, domestic demand (investment and consumption) has grown more slowly than GDP over the past year everywhere except in Malaysia (see chart 1). But in most cases the gap has been small, especially in China, India, Japan and Indonesia. In contrast, growth in Taiwan, Hong Kong and Singapore has been heavily dependent on external demand over the past year.

It is true that exports account for 40% of China's GDP, but those exports have a large import component; only a quarter of the value of China's exports is added locally. The impact of a slowdown in export growth would therefore be partially offset by a slowdown in imports. China's GDP growth has come mainly from domestic demand, which has been growing by an annual 9% in recent years.

The idea that China's growth is mainly export-led is not the only popular myth. Another, says Jonathan Anderson, an economist at UBS, is that China's consumer spending is feeble. Several recent reports highlight that according to official figures spending has fallen from 50% of nominal GDP in 1990 to 42% today. But this partly reflects an even stronger boom in capital spending. Real consumer spending has been growing at an average annual pace of 10% over the past decade—the fastest in the world and much faster than in America (see chart 2).

There is also good reason to believe that official figures understate consumer spending in China because of their inadequate coverage of services. Purchases of homes by the Chinese have risen rapidly since they were first allowed in 1998, but these are also excluded from the figures. If they are added in, Mr Anderson calculates, total household spending has not fallen as a share of GDP.

How does this square with the common perception that Chinese household saving is extraordinarily high and rising? The truth is that it is not. The saving of Chinese households has in fact fallen from 20% to 16% of GDP over the past decade. The main reason why China's total national saving rate looks so high (at close to 50%) is that Chinese companies have been saving a much bigger slice of their booming profits.

Bags and bags of shopping

Across many other Asian countries, the notion of the frugal Asian consumer is equally flawed, says Mr Anderson. Although consumption has fallen as a share of GDP in most Asian countries, this does not mean that households are saving more. Excluding China and India, household saving has fallen sharply, from 15% of GDPin the late 1980s to 8% today. The paradox is explained by the fact that wage incomes have risen more slowly than GDP as production has become more capital intensive. But this means that Asian consumers are spending a rising share of their income by borrowing or running down their savings. Amazingly, the savings rate of Japanese households has fallen more sharply than that of American households over the past decade.

Doing their bit to help the world economy The IMF estimates that in Asia as a whole (including Japan as well as the emerging economies) real growth in consumer spending has averaged a healthy 6.3% a year in 2005 and 2006. This suggests that Asian consumers can help sustain fairly robust GDP growth in Asia even if America's economy takes a dive.

Some pundits have predicted a boom in Asian consumer spending over the coming years, which would help to fill the gap left by American consumers cutting back on their purchases. But if consumer spending is already rising strongly in Asia, there is little pent-up demand ready to explode. On the other hand, spending by firms could pick up. After the Asian economic crisis in the late 1990s, investment plunged everywhere except China. It has remained relatively weak. However, as the overhang of excess capacity and debt has disappeared, capital spending is now starting to perk up across Asia.

Japanese firms' average return on assets now exceeds long-term interest rates by 5%, the widest margin for decades, according to Merrill Lynch. The Bank of Japan's latest Tankan survey of business confidence found firms to be unexpectedly cheery. Big Japanese manufacturers now report insufficient production capacity for the first time since 1991 and plan to increase capital spending by 17% in the year to March.

Another reason for believing that Asian economies can decouple from an American downturn is that most of them have small budget deficits or even surpluses. This means they have plenty of scope to ease fiscal policy to support domestic demand so as to offset some of the fall in exports. The main exception is Japan, which has a massive public debt; Taiwan, where domestic demand is worryingly weak, is also constrained by a large budget deficit. South Korea, on the other hand, which has run a budget surplus for seven years, has plenty of scope to ease up.

The United States of where?

Not only is growth in China and the rest of Asia chiefly domestically led, but America's share of Asia's total exports has fallen from 25% to 20% over the past five years. Regional trade links within Asia have also deepened, thanks partly to growing Chinese demand. Goldman Sachs reports that five years ago China's imports for domestic use were only half as big as those for the assembly and re-export of products, but now they are roughly the same size. So strong domestic demand in China sucks in more imports.

China's exports to America have fallen from 34% of its total exports in 1999 to 25% now (adjusting for the re-exports which are made through Hong Kong). Chinese exports to the European Union are now almost as big as those to America and are growing faster.

"When America sneezes, the rest of the world's economies may no longer catch a cold" America takes only 23% of Japan's exports, down from almost 40% in the late 1980s. However, this understates Japan's total exposure. Japanese firms (like those in South Korea and Taiwan) send a lot of components to China for assembly into goods, which are then exported to America as finished products. On top of this, if a sinking American economy pulled the dollar down with it, this would further squeeze Asian exporters.

A recent report by Peter Morgan at HSBC estimates that slower American growth will hurt China, India and Japan much less than it will the smaller Asian economies, such as Singapore, Taiwan and Hong Kong, that are more dependent on foreign demand. China, India and Japan account for three-quarters of Asia's GDP and so, given the deeper regional trade links, they should help to support demand in the whole region. If America's GDP growth slows next year to 1.9%, from 3.5% in 2006, as HSBC expects, then Asia's growth is tipped to slow from just above 7% this year to just below 6% in 2007. Weaker exports will badly hurt some industries, but overall, the region will continue to grow at a reasonable pace.

Could Asia withstand a sharper American slowdown? Hong Liang at Goldman Sachs estimates that if America's GDP growth drops to zero by the end of 2007 then China's annual export growth could plummet from 26% in early 2006 to a decline of 2% by late 2007. That sounds dire. Yet after taking account of the impact of slower export growth on imports and domestic demand (ie, slower growth in investment), Ms Liang estimates that China's GDP would still expand by a respectable 8%. That is significantly down from this year's growth rate of over 10%, which is still too fast to be sustained. China is today tightening policy so as to slow down its runaway economy: weaker external demand could be partly offset by reversing these measures.

In sum, if America suffers a slump, the economies of China and the rest of Asia would slow, but they are unlikely to be derailed. However, a slowdown in America could affect Asia indirectly through other channels. Most important and least certain of all would be the impact of an American recession on financial markets. Even if economies can decouple, global financial markets tend to be more tightly linked through the investment strategies of hedge funds and the like. If America's economy hits the buffers, this will surely trigger a rise in risk premiums and a drying up of market liquidity, pushing share prices lower in Asia as well as in America. When America sneezes, the rest of the world's economies may no longer catch a cold; but if Wall Street shivers, global tremors will still be widely felt - THE ECONOMIST Oct 19th 2006

China is the third largest market for luxury goods in the world, behind Japan and the United States. It accounts for 12 per cent of global sales, and by 2010, 250 million Chinese, 17 times more than today, will potentially be able to afford luxury products. - AFP 2007 March 19Luxury market elusive

HONG KONG -- China's luxury market is proving harder to crack than many overseas companies anticipated, even as incomes soar and economic growth tops 10 per cent.Luxury goods makers count on big-spending Chinese

Dozens of high-end brands, from Cartier and Chanel to Hermes and Versace, are chasing the nation's limited pool of big spenders. That's made profits elusive for most. "China is a growing force in the luxury business, but the market isn't large enough yet to accommodate so many players," says Ivan Kwok, a manager at Boston Consulting Group in Hong Kong. Only about one in 10 overseas consumer-goods companies is profitable in China, he says. The winners are the ones whose products are seen by Chinese consumers as obvious symbols of wealth, he says. - 14 January 2007

(SHANGHAI) Forget about Paris and New York. Chinese dying for haute couture gowns or the latest luxury bags can now shop right at home.

Makers of luxury apparel, liquors and other goods increasingly are looking to China, India and other developing countries for growth they won't find in older, established markets in Europe.

To meet soaring demand for Asia's newly affluent, venerable names like Prada and Giorgio Armani are setting up stores as quickly as they can - and even mulling making some of their products here.

'China is certainly the most prominent and most important market we have in front of us,' Paolo Fontanelli, chief financial officer for Giorgio Armani SpA, told a conference on luxury brands held recently in Shanghai.

Although China, Taiwan and Hong Kong together account for only a tiny fraction of Armani's sales, the fashion group is quickly adding stores in the country, both in major cities like Shanghai and in lesser known ones, like Shenyang in the north-east and Chengdu in the south-west.

And while the company led the way in setting up a flagship store on Shanghai's riverfront Bund, just about all the big names now have boutiques in the trendy districts of Shanghai and Beijing.

China is the latest, biggest frontier in the luxury goods market, with India and Russia close behind, said Melanie Flouquet, luxury goods industry analyst for JP Morgan.

'Emerging markets are not only not insignificant but they are critical for growth going forward,' Ms Flouquet said, adding that China accounts for 5 to 6 per cent of sales of European luxury goods, with Russia at about 3 per cent and India at one per cent.

Chinese travellers have also joined the Japanese - long notorious for their love of name brands - as an important clientele for luxury shops in Paris, New York and Hong Kong.

Yet although shopping in Paris, Milan or Hong Kong still carries a certain cachet, buying overseas is no longer the only way for shoppers to dodge the fakes that are rampant here.

With so much potential growth at stake, Chinese consumers, especially the wealthy ones, have become the focus of intense analysis - as are those in India and Russia.

Until recently, men accounted for more than two-thirds of spending on luxury items in China.

But that's changing as women with rising incomes splurge on ladies wear, luxury cosmetics and fashion accessories, said Ms Flouquet, of JP Morgan.

Just about all the big names now have boutiques in the trendy districts of Shanghai and Beijing.

Conspicuous consumption is in - the pages of Shanghai's fashion magazines are plastered with shots of society belles in Dior and Versace.

Research shows that the Chinese tend to buy luxury products without a lot of study or research, while many in Europe and Russia tend to focus on the 'genuine value' of what they buy. - AP 24 May 2005

China may save the world's luxury goods industry, just as it has rescued producers of soybeans and iron ore.Real estate boom fuels China's luxury car craze Newly minted multimillionaires drive up demand but there are signs of property slowdown and concerns about wealth gap

The South China Morning Post reported yesterday that Chinese citizens last year accounted for 12 per cent of global luxury goods sales, according to a report by Goldman Sachs. Demand for such goods by Chinese travellers will grow 20 per cent a year until 2008 and 10 per cent from then until 2015.

Ten per cent of luxury goods were sold to Chinese travellers abroad, including in Hong Kong, while 2 per cent were sold on the mainland.

In Europe, the average Chinese traveller spent 550 euros (S$1,180), the report estimated - about the same as Japanese tourists spend. By comparison, the average Russian in western Europe spent 700 euros, and Americans spent only 450 euros.

By 2010, Chinese could account for nearly 20 per cent of the industry's sales, the report projected. Within 10 years, Chinese luxury consumers will catch up with their counterparts in Japan, now the biggest spenders, accounting for 41 per cent of sales.

The numbers are attracting global luxury goods firms to open outlets in China, such as Giorgio Armani's swank display at Three on the Bund, says the Post.

Setting up in the mainland is often a brand-marketing exercise more than a bid to make huge sales - taxes and duties make luxury goods 30 per cent more expensive in Shanghai than in Hong Kong. At Plaza 66, a Shanghai skyscraper with one of the biggest collections of luxury goods in the city, window-shoppers far exceed customers.

They are there to decide what to purchase in Hong Kong, Paris or New York. The companies do not mind: the rent is considerably cheaper than television advertising.

The lure of the Chinese market is strong enough to attract Prada chief executive Patrizio Bertelli, Giorgio Armani chief financial officer Paolo Fontanelli, WPP Group chief executive Martin Sorrell and other big names to the 'Business of Luxury' summit here next week. The event is being held at the Shanghai Exhibition Centre, formerly the Hall of Sino-Soviet Friendship.

The luxury market in China consists of 10-13 million people, mostly entrepreneurs and young professionals working for multinational firms and living in the major cities of the east. They travel frequently and have buying habits similar to those of Japanese, who started to go abroad in large numbers in the 1980s. - SINGAPORE BUSINESS TIMES on 13 May 2005

"China, with Hong Kong and Taiwan, represents 10 per cent of the total business of Christian Dior couture." - Pierre Denis, Dior couture and perfume Asian rep AFP

BEIJING -- A new report portrays Chinese consumers as a sophisticated, brand-loyal and often dissatisfied lot, puncturing their longstanding image as fickle and penny-pinching.

In its first report on consumers in China, Kurt Salmon Associates, an Atlanta-based retail and consumer-products consultancy, concludes that Chinese shoppers have developed discerning tastes and preferences at warp speed.

Middle-income residents in four cities said the critical factors in choosing a brand are trust in its quality, a positive impact on health, and its care for customers; having a fair price ranked only fifth. In choosing a shopping destination, quality, service and variety were the top three factors, with value coming in fifth.

"The conventional wisdom was that the Chinese consumer will buy whatever's cheapest," says Mohan Komanduri, the consulting firm's principal and regional director of East Asia. "The fact that they are putting quality before price means that the Chinese consumer is becoming more sophisticated."

The report, to be released on Aug. 16, was based on interviews with 600 residents in Beijing, Shanghai, Chengdu in the interior and Shenyang in China's northeast. The company plans to issue an annual China report to keep up with rapid changes in the marketplace.

Those surveyed, who had monthly household incomes ranging from $300 to $1,200, showed a high level of brand awareness. Asked to identify the products made by a variety of brand names, 83% of consumers on average were able to do so.

Loyalty to brands is also high. For toiletries, 78% said that they buy brands they know and that they are unlikely to switch if their brand isn't available. The study suggests that those who still regard China as a wide-open market will have to rethink those assumptions.

Preferences for foreign or local brands diverged markedly depending on the product. Asked whether they preferred to buy a local or foreign brand offering products of identical price and quality, consumers overwhelmingly preferred local brands for food, toiletries and household items. But for consumer electronics and home-improvement items, they opted for international brands. In clothing, the two groups were evenly split, though European brands were seen as more fashionable than Chinese or American labels.

"They're fundamentally Chinese in the things they put in their body or on their body," Mr. Komanduri says. The message to multinationals, he adds: "If you're doing consumer goods, try to look Chinese," rather than emphasizing a product's international roots in packaging or marketing.

Consumer dissatisfaction also ran high. The report found that people shop once a month or less for things such as consumer electronics and clothing, suggesting that shopping isn't a favored leisure activity for large segments of the population. According to the survey, 48% of women said they dislike shopping, outnumbering the 30% of U.S. women who say the same. Meanwhile, 63% of men disliked shopping, putting them roughly on par with their U.S. counterparts. Chinese shoppers on average said they found what they were looking for only 5.4 out of 10 store visits, suggesting that retailers need to do a better job managing inventory and designing store layouts.

The report also shows a retail sector in a state of flux and fragmentation. For example, consumers do their food shopping at supermarket chains almost twice as often as they do at traditional open-air markets or hypermarkets. But hypermarkets are growing in popularity: About 40% of people are shopping more in these large-scale stores this year compared with last year. For clothing and shoes, people favored department stores. But they went to local specialty stores for consumer electronics, and superstore chains for home-improvement items. - by Leslie Chang Staff Reporter of THE WALL STREET JOURNAL August 6, 2004

BEIJING - Mr James Wang, a 27-year-old developer of golf courses and luxury homes, was one of China's first two buyers of the Maybach 62, a 6.1m ultra-luxury sedan marketed as 'the private jet of the road'.Armani opens in Shanghai

At the Beijing auto show on Wednesday, he went on stage to accept a crystal model of the keys to a silver Maybach that had already been delivered to his home.

Mr Wang said that he had bought the car for the equivalent of US$900,000 (S$1.6 million), including taxes, and had chosen it because he liked both the driving performance and the comfort of the rear seats.

But he was vague about how he could afford a car that costs the equivalent of 1,200 years' wages for a typical Chinese factory worker.

Mr Wang's riches are a sign of the powerful economic boom that has gripped China, pushing up property values in major cities in the country.

His purchase also highlights how a few Chinese families have accumulated extraordinary wealth, which has led to some nervousness among the rich themselves and some concern among China's leaders about the potential for a political backlash over sharply widening wealth inequality.

Indeed, even as Mr Wang accepted his Maybach key in person, the buyer of the second Maybach sent a man who refused to name his employer.

Sales of luxury cars have taken off even though China has some of the world's highest car prices.

Beyond the basic cost, buyers here pay a 17 per cent value-added tax, an additional consumption tax of up to 8 per cent and, for imported models, a 32 per cent tariff.

And Mr Wang is just the kind of newly minted multimillionaire that the world's luxury car manufacturers are eagerly chasing.

Automobili Lamborghini Holding, a subsidiary of Volkswagen's Audi unit, signed papers this week to open dealerships in Beijing, Shanghai and Guangzhou.

'Chinese people love brands and have a good feeling about extreme luxury,' said Mr Werner Mischke, chairman of Automobili Lamborghini Holding.

Ferrari and Aston Martin, the Ford Motor subsidiary that has supplied cars for many of the James Bond movies, have also announced plans to enter the Chinese market.

Last year, China accounted for more than a third of worldwide sales of the 760Li, BMW's most expensive model, which costs US$250,000 here.

Many of the buyers are making fortunes in real estate.

But for all the wealth apparent now, there are hints that the boom may not last.

Alarmed by a recent acceleration of inflation, Chinese regulators have begun urging banks to lend more cautiously, especially for real estate, and have imposed land use restrictions. Actual property prices and rents have been falling.

A few car executives are starting to become nervous.

'The real estate side is definitely slowing down, and that will affect everybody,' said Mr Bill Begg, general manager of Ford Motor's Land Rover and Jaguar subsidiaries in China. -- New York Times SINGAPORE BUSINESS TIMES 11 June 2004

(SHANGHAI) Giorgio Armani was so impressed by a fake Armani watch he bought for US$21 in Shanghai, he decided to make some watches in China at a lower cost. Now the Italian fashion designer plans to open 30 boutiques there by 2008.

Other than Armani, Prada Holding NV, Cartier Inc and other luxury brands are also expanding in China, betting that sales of their goods will rise in line with increasing affluence.

Imitators may not dent profits, according to analysts such as Eric Wong, of UBS Securities Asia Ltd in Hong Kong. 'There may be a lot of demand for fakes, but there is a lot of demand for the real thing too,' said Mr Wong.

Armani's sales in China rose 17 per cent in the first quarter, almost twice the overall gain, the company said. It did not disclose revenue. Total profit surged 14 per cent to 134 million euros (S$268 million).

Sales by Geneva-based Cie Financiere Richemont, which owns Cartier, rose 10 per cent in the first quarter on higher demand in Asia and the Americas, the company said.

Amsterdam-based Gucci Group and Paris-based Louis Vuitton get about 30 per cent of their combined 4.3 billion euros in revenue from Asia, excluding Japan, according to data compiled by Bloomberg.

China's luxury goods market is worth about US$2 billion, or 3 per cent of the world's total, Xinhua news agency reported in February. About 210,000 of China's 1.3 billion people are millionaires in US dollar terms, according to the 2003 World Wealth Report compiled by Cap Gemini Ernst & Young.

It is impossible to estimate how much luxury-brand companies lose to Chinese imitators, said Maxime Elgue, the managing director of Cartier Far East.

Half of the US$100 million in counterfeit goods seized by US Customs officials in 2002 were from China, according to the International Chamber of Commerce.

The government must do more to combat counterfeiting, Mr Elgue said. 'They need to convince the country that fakes are bad for them.' he said. 'We're spending millions every year to sue companies, to terminate workshops.'

Meanwhile Cartier, famed for diamond-encrusted watches, plans to add seven stores in China this year for a total of 10, Mr Elgue said. The company wants 20 stores by 2006.

'We know it'll be the market for the future,' he said. 'We need to step ahead of the competition.'

Cartier opened its first Chinese boutique at the Peninsula Palace Beijing hotel in 1997. It will set up in some of China's richest cities this year, including Guangzhou, Shenzhen, Harbin, Hangzhou and Chengdu.

China may overtake Japan as Cartier's biggest market in 15 years, Mr Elgue said. 'The sky's the limit.'

Armani plans to add two stores in Shanghai this year to bring its total to eight. He opened his first Chinese boutique in Beijing in 2002.

'If you look at our competitors, their share of the pie from Asia is significantly greater,' said Robert Triefus, Armani's executive vice-president. 'We feel that there is great opportunity to expand that percentage.'

Prada, a closely held Milan-based Italian designer of shoes and handbags, said it plans to spend 35 million euros to open as many as 15 stores in China through next year after entering a decade ago.

'China is a fast-growing nation, so it's creating the opportunity to open new stores,' said Giovanni del Vecchio, Prada's Asian director. - Bloomberg 22 May 2004 Singapore Business Times

China's luxury goods market is worth about US$2 billion, or 3 per cent of the world's total, Xinhua news agency reported in February.

Brands pay premium for value

Never in Hong Kong's history as a shopping haven has so much prime retail space been devoted to selling so many expensive non-essentials to so few. Just 8 per cent of its residents are likely to buy luxury branded items such as Louis Vuitton bags or Tiffany baubles.Chinese furor over fortune and fame

Yet in recent years Central landlord Hongkong Land Holdings has transformed first Prince's Building, then Alexandra House, Chater House and now Landmark into miniature A brand cities. Chater House now boasts 27,000 square feet of luxury retail space.

Causeway Bay has followed suit: there is the Lee Gardens, whose owner Hysan Development is capitalising on the success of Hysan 1 by converting the Caroline Centre into Hysan 2.

In Tsim Sha Tsui, Wharf (Holdings) is on the same track with wall-to-wall designer brands lining Canton Road. And then there is 1 Peking Road.

"It's actually nothing new," said Ian Hawksworth, an executive director at Hongkong Land. Luxury flagship stores do not happen overnight. "It started in the mid-to-late 1990s as the big brands realised they wanted flagship stores in Hong Kong."

Dick Groves, a regional director and retail sector specialist at Jones Lang Lasalle, said: "What's going on in Central is a very smart move by Hongkong Land. They spotted the trend in other big cities of putting luxury outlets on higher floors - retail rents are higher than office space."

So just how much rent is a brand such as Giorgio Armani, with its 6,000 sq ft emporium, forking out in Central? "About HK$5,000 per square foot, prime," Mr Hawksworth said, "and increasing in recent months, but historically smaller locations trade higher."

The impact on rents of the New York World Trade Centre attacks and of Sars was nowhere near as severe as the 1997 financial crisis, he said.

Luxury brands would not be squeezed on the rent, FPD Savills director Nicholas Bradstreet said. "In international tables you might see Hong Kong topping retail rent tables, but that's not luxury brands. It's because small spaces at high rents distort the figures," he said, adding luxury brands preferred to huddle together in shopping centres, in clusters.

Brands rarely get rent discounts, generally paying market value.

Luxury brand lease structures, for fashion companies, are generally a base rent plus 12 per cent to 15 per cent of sales, explains Mr Bradstreet. Leases are typically for three years or six, with a rent review after three.

So considering the overheads - and what a February 27 Morgan Stanley equity research report calls "low sales per square foot" for brands in China - do they really make money, or do they serve as hugely expensive advertising vehicles to maintain visibility?

Retail property agents admit some brands sink the advertising budget into their Central rent bill. Squeezing any pertinent figures out of the brands themselves is fruitless. They are happy to twitter about their products but shy away from any question that strays beyond public relations fluff.

Asked why Louis Vuitton was expanding its Landmark emporium, a spokeswoman said it was because Prada would be opening its Central store next month.

Since the Italian brand spent US$82 million for its Tokyo Omate Sando Street store, this could prove a hard act to follow, Mr Groves said.

How is their business split between mainland and Hong Kong customers? "We can't reveal that," the Louis Vuitton spokeswoman said. And a query on the average spending per customer in their six Hong Kong stores drew a blank.

As to whether the prime objective of these costly flagship stores is profit or brand visibility - in short, do they make money? - she retorted: "Your question is a strategic one."

Mr Groves doubts that many flagship brand stores make money. He is watching the new Louis Vuitton store at 57th and 5th avenues in New York with interest after previous flagships flopped. "Boss opened theirs on 56th and 5th in 1997-98, then there was Gap and Brooks Brothers - they didn't work," he said.

"The brands need to be clear about flagship stores. Do they upgrade the brand? I'm not sure. I really question if flagships make money. When a store like Prada in Tokyo costs US$82 million, they are not looking at profit."

In Hong Kong, Mr Hawksworth believes it is simply that they all have their eyes on the China market. "As a business group, we're very excited about the Hong Kong market as a stepping stone for China and it's the chance to capitalise on the mainland tourists."

But mainland first-timers tended to be intimidated by Central, Mr Bradstreet said. "It's too formal. They like Causeway Bay because it's young, happening and casual. They like to shop in Mongkok, Causeway Bay and Tsim Sha Tsui."

This is reflected in the product offer. "In Landmark, you see more big-ticket items like frocks and ball gowns aimed at tai tais, but in Causeway Bay, it's belts, more inexpensive items that appeal to mainlanders."

Nevertheless, Mr Hawksworth said Central was the destination of choice for high-end shoppers and a look at Landmark proves him right. Upmarket London name Harvey Nicholls is coming, so too is Fendi, which is opening in the third quarter, and Christian Dior, whose new 6,500 sq ft flagship opens its doors in May. Louis Vuitton is upgrading to 18,000 sq ft, on a par with its big New York, Paris and Tokyo stores.

"We've managed to establish Central as a premier world shopping location now; it ranks with Tokyo, London, Paris. That's been our strategic objective since the mid-1990s." Going forward, brands saw their focus was definitely the China market, Mr Hawksworth said.

"China's developing very nicely for luxury brands," Mr Bradstreet said. "And places like 1 Peking Road are making money - mainlanders stay in three-star Mongkok hotels and head straight for Harbour City to shop."

Hugo Boss would agree, with 50 shops in Hong Kong and China and a further 10 opening this year.

The Morgan Stanley report sheds light on the mainland shopper proposition. China domestically and via tourism could become a big market for luxury goods, it says.

The market could become 100 million - 8 per cent of the population - although the luxury goods market now is just 1 per cent, or 13 million mainlanders. Japan, the other big, but mature, market for European brands, offers a useful comparison, the report says. The population of Japan is 127 million,

Coach says it targets the top 60 per cent of households in Japan. Therefore, conservatively, a brand could see its potential business in China to be at least half the figure for Japan.

"Bulgari has stated that it believes China could represent 10 per cent of its sales in 10 years' time," the report says, compared with 0.05 per cent now and 22 per cent in Japan. Gucci believes its sales in Asia, excluding Japan, could triple to 30 per cent of total sales, from 12 per cent now, in 10 years, driven by China.

Brands report that mainland shoppers like to shop here because goods are at least 30 per cent cheaper than in their home market due to the absence of mainland import duties. They also like the assurance that the merchandise is genuine. The Comite Colbert, an association of 65 French brands, says that this is a crucial part of Hong Kong's appeal.

Fakes do not tempt Chinese buyers interested in acquiring status symbols and the genuine article, according to the group's chief executive, Elisalbeth Ponsolle des Portes, on her recent trip here.

Morgan Stanley concludes the China market is still small but said: "Investing in China is a brand-building exercise rather than a profit driver. We see payback for most brands as at least five years away. Due to low sales per square foot, brands need to be present to educate consumers." - by Anna Healy Fenton March 30 2004 South China Morning Post

BEIJING - Whether their fame comes from the court, the stage or the silver screen, Chinese celebrities are beginning to ride the wave of riches, fame and publicity, largely due to the country's rapidly growing entertainment industry. And this month, Forbes China, the Chinese-language edition of US-based Forbes financial magazine, only added to China's increasing preoccupation with wealth and celebrity.Asia's Wealthy Number 55,000

In the 1980s, paramount leader and reformer Deng Xiaoping told a skeptical and rigidly egalitarian nation: "Getting rich is glorious," but today, it seems that getting too rich and too glorious invites anger, envy, tax audits and corruption probes. A new atmosphere of political correctness is making some celebrities coy about their wealth.

The first Forbes China Celebrity List, modeled on Forbes' annual celebrity 100 list, was published on February 10 - lifting the veil on the country's sometimes - and sometimes not - publicity-shy entertainers, and simultaneously causing a storm with its assessment of growing wealth and fame in an industry once assigned by the Chinese Communist Party to serve the masses.

The list surveyed the income and popularity of Chinese-born celebrities in film, sports, media, music and publishing. Basketball star Yao Ming, who plays for the Houston Rockets in the United States National Basketball Association, topped the list with a reported income of US$14.6 million. Although Yao led the way, his income was topped by Hollywood star Jet Li, ranked No 10 in popularity, but who, with earnings of $17 million, had the highest 2003 income among mainland Chinese celebrities. Rankings are based on popularity, not strictly wealth.

Chinese actress Zhang Ziyi, star of the Oscar-winning film Crouching Tiger, Hidden Dragon, came in second with an income of $3 million. Third place went to Zhao Wei, China's most-interviewed movie star, whose movies roles last year earned her $2.3 million. Faye Wang, the Beijing-born diva and one of the Chinese-speaking world's most popular singers was No 4, and international film star Gong Li was No 5 at $3.4 million.

The list is ultimately a ranking of celebrities based on their exposure and popularity, however, much attention is being paid to the income figures on which their fame now rests. As such, the list has provoked fury both among China's entertainers and its ordinary Chinese. A series of state-run publications has denounced the ranking of wealthy entertainers as ''sheer nonsense'' and quoted some ranked Chinese celebrities as questioning the figures used to calculate their incomes.

Embarrassed singer downplays her wealth

Pop singer Han Hong slammed the ranking, which placed her 12th on the list and calculated her income at $2.4 million a year. ''Even people with a little knowledge of the entertainment circle in China know it is impossible for an actor to earn that much in a year,'' the state-run Xinhua News Agency quoted the singer as saying.

The English-language China Daily carried a report titled: ''Celebrities: Forbes list sheer nonsense'' and quoted dancer Huang Doudou, actress Deng Jie and actor Zhang Guoli as saying the magazine had incorrectly assessed their incomes.

An editorial in the Beijing Star Daily went on to accuse Forbes magazine of ''pursuing its commercial interests by taking advantage of the fame of celebrities''.

The uproar highlights shifting attitudes toward wealth in what many claim was once a classless society and where China's affluent elite are now making a boisterous and ostentatious comeback. At the same time, it underscores public fear of the government's crackdown, especially a tax crackdown, on celebrities and business people known for flaunting their wealth.

A string of fledgling Chinese multimillionaires - many of them audacious about advertising their wealth, power and independence - have fallen in the tax dragnet of communist authorities in the past three years. Many of them had appeared on Forbes magazine's annual list of the wealthiest people in China - not just celebrities.

One of the most prominent tax "victims" is actress Liu Xiaoqing, a glamorous starlet-turned-businesswoman, who unabashedly proclaimed herself to be China's first female billionaire.

Nouveau tax scofflaws to be punished

Even as the Chinese Communist Party has welcomed private entrepreneurs into its fold and is preparing to enshrine the rights of private property owners in the country's constitution, Beijing is driving home the message that the nouveaux riches must pledge obedience to the ruling party and comply with the laws on the books, just like everybody else.

A crackdown on alleged corporate malfeasance has caused the downfall of more than one Chinese capitalist, including orchid tycoon Yang Bin and Yang Rong (no relation), one of China's richest automobile businessmen. Yang Bin and Yang Rong were ranked second and third in the 2001 Forbes rich list.

The publicity, which has accompanied the disclosure of many corruption and tax fraud cases, has encouraged the wealthy to be coy and quiet about personal wealth.

''Traditionally, Chinese people like to make known the pride and honor they have brought to their family by striking it rich,'' said Zhao Wei, a private practitioner of Chinese medicine, who in the last year managed to buy a villa and a car - the ultimate symbol of wealth for China's emerging middle class.

The downfall of some Chinese tycoons also is thought to have been politically motivated. Zhou Zhengyi, for instance, a Shanghai property tycoon, has been a prime target of tax investigators now for months, and experts who asked not to be named say that his influential political contacts with former president Jiang Zemin may have added to his woes.

Yet on the whole, the corruption drive has sought to shore up the ruling party's waning legitimacy by curbing graft and jailing big tax cheats.

Party cadres the biggest targets in clean-up

A recent report in the state-run media revealed that so far the biggest number of targets in the party's clean up campaign have been communist party members themselves.

According to a January report in Wen Wei Po, a Hong Kong-based newspaper, more than 1,200 communist party cadres killed themselves and another 8,000 fled overseas during an anti-corruption crackdown in the first six months of 2003.

When Deng Xiaoping embraced market reforms in 1980s, he discarded communism's egalitarian code by declaring that ''getting rich is glorious''. With the unleashing of private enterprise, China's manifestations of private wealth have increased and self-help books like Robert Kiyosaki's Rich Dad, Poor Dad have become bestsellers.

However, there are mounting concerns that all this rapid accumulation of wealth might be getting out of hand. The income disparity between the super rich and the poor has expanded to its widest point in more than a century. In recent months, the capital has witnessed harrowing scenes of people setting themselves on fire because of poverty and social deprivation.

Since assuming power last spring, President Hu Jintao and Premier Wen Jiabao have stressed that the government must put the public interest first and must always focus on issues that are closest to the public's heart. They are said to be planning new moves to punish those who have amassed illicit fortunes.

And in this atmosphere of new political correctness, it's not surprising that the unveiling of Forbes' list of Chinese celebrities and their resulting wealth has been greeted by a firestorm of anger - and envy. - By Antoaneta Bezlova 20 Feb 2004 Interpress Service

Asia's wealthy swelled their ranks last year, with the number of high net worth individuals in the region outstripping the global average, according to Merrill Lynch. Many of Asia's nouveau riche have risen to their lofty financial heights on the Internet revolution of the past 12 months, having already bloated the wallets of Americans and Europeans, a Merrill Lynch report said.Citigroup gives 40 scions from region's most affluent families a crash course in wealth management

The investment bank, in co-operation with Gemini Consulting, found that the number of super-rich in Asia grew from 1.3 million to 1.7 million and they saw their bank balances improve by an average 23 per cent last year, against a global rise of 12 per cent to US$25.5 trillion.

Much of the rise was attributed to improving global economic conditions - particularly across Asia, where countries and companies emerged from 18 months of recession.

Linked to this was the performance of share markets in the region, where growth averaged 70 per cent compared with the 37 per cent global rise. In comparison, the US market rose only 29.5 per cent last year.

In its world Wealth Report, Merrill Lynch said if this rate of growth were sustained, the number of Asian high net worth individuals could begin to rival those in Europe and the US.

Globally, Merrill Lynch noted the increasing emergence of younger, active high net worth individuals, who created their wealth through technology-oriented enterprises. Public listings of Internet companies and the increasing frequency of related corporate option packages was significantly intensifying wealth creation.

Of the estimated eight million people holding liquid financial assets of more than US$1 million, about 2.5 million, or 30 per cent, were from the United States, while 2.2 million Europeans account for a further 26 per cent.

The report forecast 12 per cent growth per annum in wealthy individual assets for the next five years, reaching US$44.9 trillion by 2004.

This was not simply because of continued global prosperity and expansion of existing financial assets, but also because such individuals were likely to invest a bigger proportion of their assets in higher risk, higher yielding financial instruments, either equities or venture-capital projects, the report found.

Head of Merrill Lynch's international private client group in Hong Kong, Francis Chan, said the rising number of wealthy individuals presented a new challenge for banks to service their needs properly.

"Success would ride on critical factors such as innovation, speed, technology platform, identification of specialist functions in addition to investment - taxation, law and real estate, and increased personalisation of service," Mr Chan said.

The report also identified 55,000 "ultra" high net worth individuals worldwide - those individuals who have financial assets of more than US$30 million, a rise of 18 per cent.

"The relentless rise in [high net worth individuals] numbers and assets worldwide continued in 1999, boosted by a favourable economic environment and exceptional stock market performance," global president of Merrill's private client group, Winthrop Smith, said.

The report found that the ultra-rich take a shorter-term view of investment strategies and are less risk-averse.

They also accept only top performance and are more demanding than even normal high net worth individuals. - David Saunders South China Morning Post 3 May 2000